Gifts That Pay You Income

Photo: Christina Olivas

Enable the success of current and future students while earning an income for yourself.

Charitable Gift Annuities

When you create a legacy gift through a charitable gift annuity, you earn income for life, have lower taxes and create an academic environment that truly prepares students for success in the 21st century.

Make a substantial impact through San Jose State while you are receiving tax-favorable income for yourself, your spouse, and your children. Many supporters like charitable gift annuities because of their attractive payout rates and their significant impact. You can even avoid taxes on capital gains when you use appreciated assets.

Benefits to you include:

Payments can be made on an annual, quarterly or monthly basis.

A portion of the payout will be tax-free.

You receive an immediate tax deduction for a portion of your gift.

Your gift passes to San Jose State University outside of the estate process.

You create a legacy of helping students and creating future leaders.

“I had spent my entire teaching career at SJSU. I mentored hundreds of students, many of them the first in their families to go to a university. Most of them were working as well as going to school. I am fortunate to be able to do something for others. With my charitable remainder trust, I receive payments from the trust for the rest of my life—after which point the university receives the remainder to fund scholarships forever. A win-win situation.”

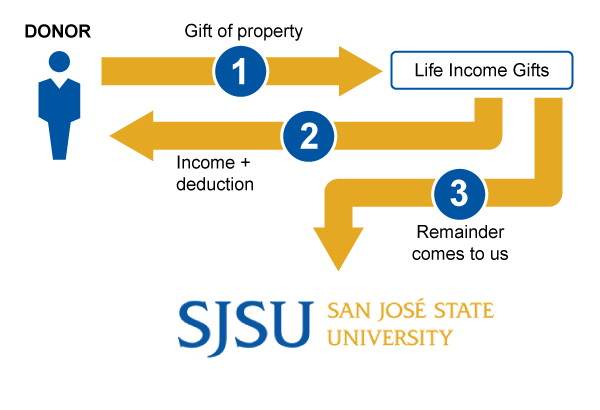

Charitable Remainder Trust

Charitable remainder trusts allow you to earn income for life for yourself and your family while reducing your taxes and promoting the education of our future leaders.

By using assets or cash to fund a charitable remainder trust, you receive income and an income tax deduction the year in which you transfer your assets. The remaining portion of the trust, after all payments have been made, comes to San Jose State.

Benefits to you include the following:

Receive income for life for you or your heirs.

Receive a charitable income tax credit for the charitable portion of the trust and potentially avoid capital gains taxes when you use appreciated assets.

You create a legacy of helping students and creating future leaders.

Your Giving Toolkit

Charitable Gift Annuities: Income for Today, a Gift for Tomorrow, and other complimentary planning resources, are just a click away!

Photo: Brandon Chew

Have Questions? I'm Here To Help!

Kendra Livingston, JD

Senior Director of Planned Giving

Phone: (408) 924-1123

Email: k.livingston@sjsu.edu